Podcasts and Capital

Observation on the podcast industry in 2021:

Many participants and investors are acting as if podcasting is bigger than it really is

VCs and bigger companies in search of "the next YouTube" fundamentally misunderstand podcasting's growth curve

Investors are way too bullish on Spotify's strategy

Social audio apps (like Clubhouse and Twitter Spaces) won't replace podcasting, and won't gain widespread use

Podcasting's growth curve

Podcasting has been growing "slow & steady" for a decade.

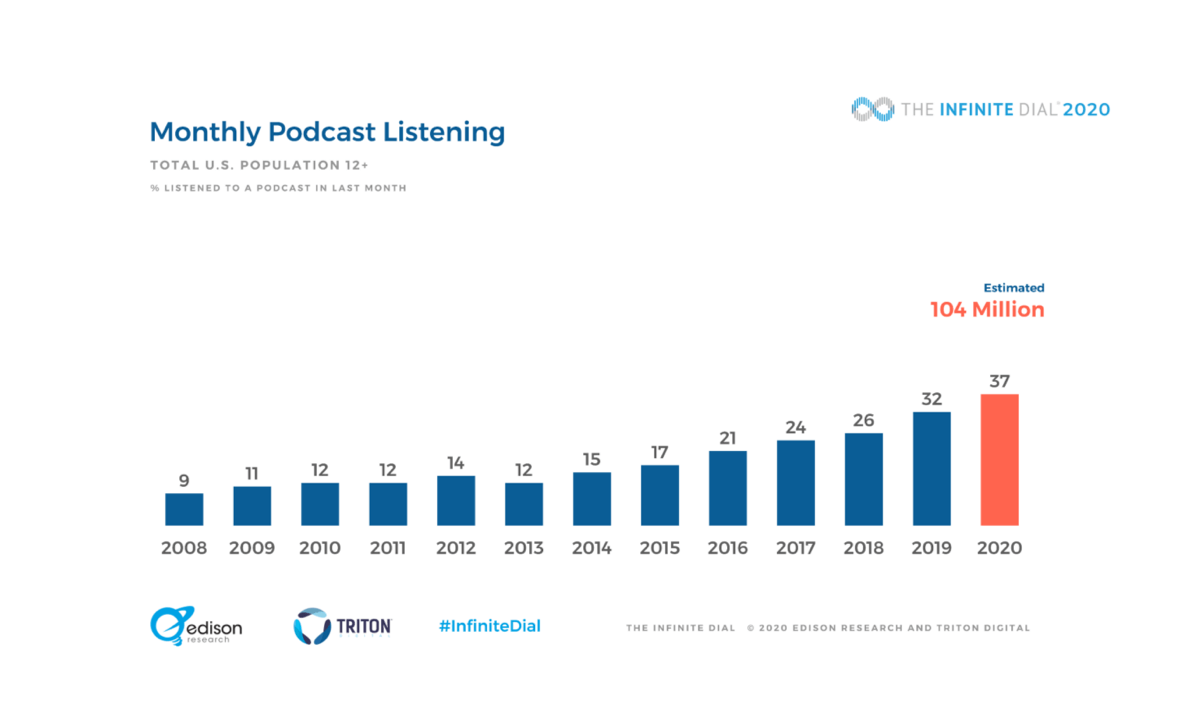

In 2020, an estimated 104 million Americans listened to a podcast monthly. Last year it grew by 16%. The previous year, it grew by 23%. Between 2017 and 2018, it grew by 8%.

You'll notice there's no meteoric growth here.

For me, this consistent, gradual growth curve is fine; it shows that podcasting isn't a flash in the pan.

I believe that steady ecosystems are better for creators. RSS is reliable and extensible. It was here long before the Big Money™ showed up, and it will be here long after.

Big Money™ in podcasting

Investors are now looking to podcasting to provide them with YouTube-level returns. (For example, Sequoia earned a 57x return on its $9 million investment in YouTube).

I'm highly skeptical that podcasting will ever provide that kind of ROI. As I've shown above, the adoption curve of audio podcasting differs from that of video, social, or blogging platforms.

The amount of money being invested in podcasting is puzzling. In the last 2 years, Spotify has spent $1 billion on podcast acquisitions.

Keep in mind that in 2021, it's anticipated that podcast ad revenue will only be $1 billion (it was $782 million in 2020).

There's a disconnect here.

I'm not the only one scratching their head at Spotify's podcast spending spree. Analysts at CITI aren't impressed:

"To date, we haven't seen a material positive inflection in app downloads or Premium subscriptions."

However, investors continue to drive up Spotify's stock price, and venture capitalists continue to invest millions in new audio startups.

The overcapitalization risk

I’m particularly worried about overcapitalization.

Overcapitalization occurs when the real value of an asset (or, in this case, an ecosystem) is significantly less than the amount invested. It's when investors realize there's no possibility for a decent return, and they jump ship.

When investors pour $1 billion or more into a podcast ecosystem that didn’t generate $1 billion in total revenue last year, that's a problem. They're hoping their money will add fuel to the fire and supercharge podcasting's slow and steady growth.

What happens if that growth doesn't materialize?

Overcapitalization has knock-on effects that won’t be good for podcasting:

Capital is centralized in mega-corporations that strive to capture as much market share as possible.

As a result, small, indie companies are acquired or have to shut down (because they can't compete).

In the short term, it's beneficial for creators: productions get funded. But when the bubble bursts, the creator/producer economy implodes. People lose their jobs. Media companies that were feeding on investor dollars close shop.

Quibi is the perfect case study for overcapitalization. Founded by Jeffrey Katzenberg and Meg Whitman as a Netflix competitor, they quickly attracted funding and talent.

They injected over $1.75 billion into the entertainment industry. However, that kind of capitalization doesn’t benefit anyone if the business model isn't sustainable. Quibi failed and was sold off for less than $100 million.

Shows were canceled, people lost their jobs, and creative dreams were dashed.

Quit trying to make the YouTube of podcasting

VCs are particularly hungry for there to be a "centralized platform" for podcasting, where "discovery, consumption, and monetization can happen in the same place." That desire serves no one but VCs and the centralized platform. One centralized platform = bad for creators.

Currently, podcasters have leverage because they own the connection with their audience.YouTubers don't have that. They're at the whim of the algorithm and monetization gods.

Trading leverage for "more distribution" is like making a deal with the devil. The devil always wins.

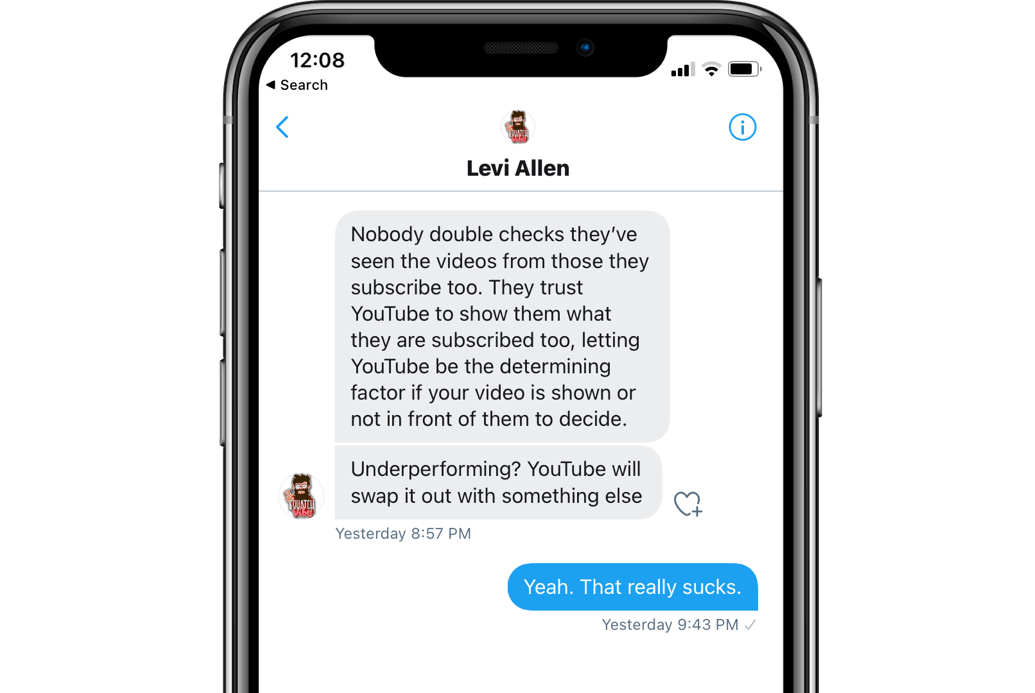

My friend Levi Allen is a super-talented filmmaker with nearly 160,000 subscribers to his YouTube channel. Having lots of subscribers used to drive a lot of views.

However, these days, most views come from videos on YouTube's homepage. "These days, it doesn't matter how many subscribers you have," he told me, "most people are just looking at the recommended videos."

There's a reason many creators are leaving closed platforms like YouTube and going to more open solutions like:

Substack, ConvertKit (email)

WordPress, Transistor, Ghost (RSS)

On these platforms, you can take your email list, RSS feed, and customer list anywhere. The creator controls the connection with the audience. On YouTube, there's no way to migrate your subscribers to another video-sharing site.

One ad marketplace to rule them all?

I'm not opposed to podcasters selling ads.

But one thing the podcast ecosystem needs to be wary of is one centralized "AdSense for podcasting."

If podcasters have to depend on a central ad platform, they'll be giving away all their leverage in exchange for low CPMs and garbage ads dynamically inserted into their show.

(Additionally: Anchor's experiment in this space seems to be failing.)

Clubhouse and social audio apps

In their quest to find ways to leverage audio as a platform, many VCs have turned to Clubhouse. Clubhouse is a live audio streaming app where participants join rooms and interact in real-time.

I enjoy conversations on Clubhouse and Twitter Spaces, but I think folks are too bullish on the format.

After participating in dozens of conversations, I’m still not convinced that social audio will replace (or significantly reduce) podcast listening. It’s less “audio entertainment” and more “networking/social event" (I think it competes more with meetups than podcasts).

I'm honestly confused by Clubhouse's $1 billion dollar valuation. I don't see social audio being widely adopted. Currently, it's being used primarily by early adopters, but not the general population. And, once the pandemic ends (and people can meet in person), I anticipate social audio app usage will decrease.

Already, we're seeing "Clubhouse burnout." Hosting a room takes hours to gain traction (sometimes as long as 6-8 hours!). As a listener, you can wait for hours to get a chance to speak or to garner any valuable insight or entertainment. Paradoxically, as more participants join a Clubhouse room, the fewer opportunities for participation there are.

Podcasting isn't broken

I'm not saying podcasting is perfect, or that it can't be improved.

But it's not broken either.

I was sitting on a ski lift with a guy who asked me what I do. "I’m in podcasting," I replied sheepishly. "No way!" he said, "I just discovered podcasts. I’ve been listening in my truck every day when I go to work."

How did he hear about podcasts?

A friend recommended a show.

He found the Apple Podcasts app on his phone.

He clicked "Subscribe," and listened.

Podcast discovery is working, it's just not "viral." It takes longer to build an audience. But if you take the shortcut and outsource discoverability to a central platform, you lose control.

What works? "Make something so good people talk about it."

Then, get scrappy and find opportunities to grow your show on your terms.

I believe that podcast listeners are one of the best audiences in the world. And I'm highly skeptical of any outside source that wants to take this audience and "juice it" to get better returns.

Slow and steady wins the race. Podcasting doesn't need "VC-sized" returns.

Cheers,

Justin Jackson

@mijustin