Same effort, but better results

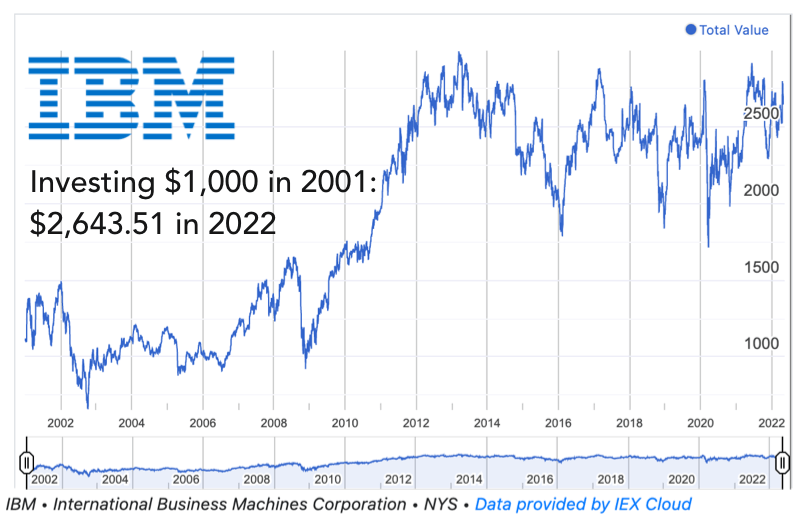

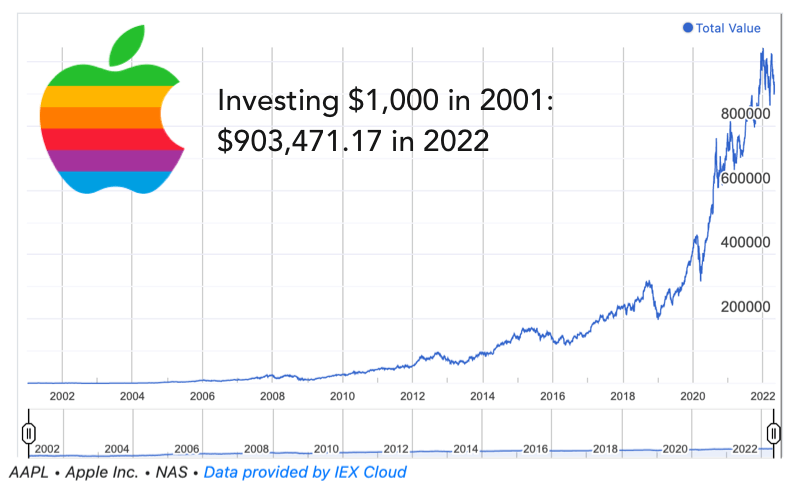

Back in 2001, Bob and Jane each picked a stock and invested $1,000.

Bob picked IBM. Jane picked Apple.

Bob's $1,000 investment in IBM turned into $2,643.

Jane's $1,000 investment in Apple turned into $903,471.

Making better bets as entrepreneurs

I've told the story above to illustrate a broader point for startup founders.

Two founders can start at the same time, with the same resources, and one can do wildly better than the other.

The difference in the "effort to reward ratio" is almost always attributable to which market you choose.

To me, it's fascinating that two people can invest the same amount of time, money, and resources, but one person can get a 10x, 100x, or 1000x better outcome.

Some of this can be explained by "luck," but this multiplication effect can also be achieved by making better bets.

Warren Buffett's investment strategy relied on making better bets. As Bill Gates explained in HBR:

"Warren says that in your lifetime you should swing at only a couple dozen pitches, and he advises doing careful homework so that the few swings you do take are hits."

How does this apply to indie entrepreneurs?

We have to get better at making bets. We can't, as Buffett says, "swing at every pitch."

To make better bets, we really need to do our research (this could include doing smaller experiments). But we're looking for evidence that the market it "pulling" for a particular product or solution.

It also means we have to be patient: founders shouldn't go after every opportunity (we shouldn't swing at every pitch that comes our way).

Too often we equate "more effort = more success." But in business, it's market demand that multiplies our efforts. You'll put $100 worth of effort in, and get $1,000 out.

This doesn't mean we'll hit every pitch that comes our way, but if you're selective, you'll know when you've hit a home run.

Cheers,

Justin Jackson

@mijustin

PS – here's one way business isn't like baseball: you don't need to stay committed to a "swing" you've already taken. Part of making better bets is being able to move on from a bad bet.